The Cannon

- ForAmerica

- Jan 10

- 3 min read

Your daily blast of infotainment from ForAmerica.

Saturday, January 10, 2026

The House Should Follow the Freedom Caucus

On Wednesday, the House GOP met at the Trump-Kennedy Center to make plans for 2026 and set their legislative agenda. Among the various topics, healthcare and the cost of living issue are reported to be at the top of the agenda. Although the meeting was closed-door, President Trump gave a broadcast speech to kick off the event where he weaved around topics but emphasized priorities like passing the SAVE Act, unravelling the ‘Unaffordable’ Care Act, and owning the issue of healthcare all together.

Of the House Republican Caucus, about 30 or so belong to the House Freedom Caucus — a group of the most conservative members of the House that often vote as a bloc to advance a more conservative agenda than we typically see out of the GOP generally.

With another government shutdown looming on January 31 if Congress can’t pass another spending bill, the GOP retreat is a good time to unite the party and solidify what Republicans are trying to achieve. But before the GOP convened, the House Freedom Caucus shared their letter to Speaker Mike Johnson laying out their agenda — all good stuff.

The 16-point plan covers everything from securing elections to rebuilding home ownership to destroying the Somali fraud ring in Minnesota and everywhere else. We’ll go into more of the Freedom Caucus’ agenda in the coming days, but we’ll start here with their first point — and one that is fully supported by President Trump — passing the SAVE Act and securing our elections.

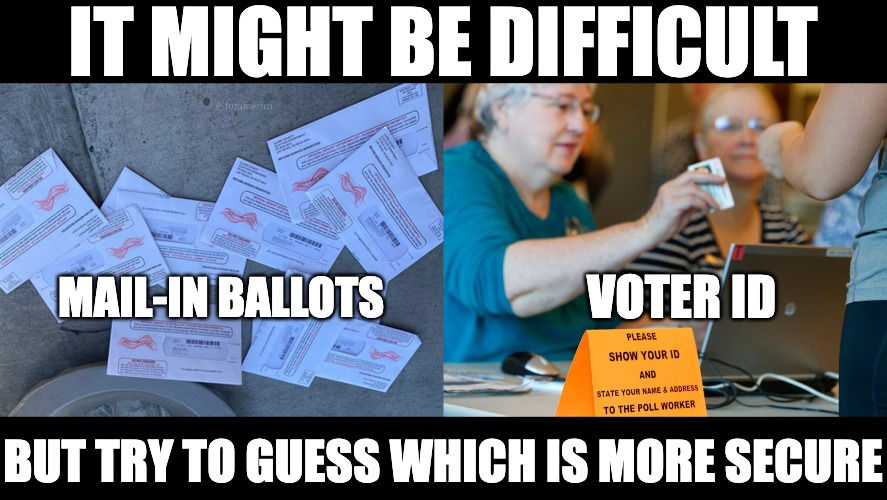

The SAVE Act would require proof of citizenship to register and vote in American elections, providing states with the tools for citizenship verification. This crucial bill passed the House back in April, but the HFC wants to not only ‘force action’ in the Senate, but to add additional election integrity measures like “Same Day” voting, paper ballots, and correcting the census for 2030 to only count citizens for purposes of apportionment.

These election security initiatives are necessary steps to preserve our elections and there are no good reasons for the GOP to not get these done.

Funniest Things:

Those don't belong there...

A lot of reading to do...

Like magic!

Thanks for reading today's Cannon!

The fight for America's future continues — online, in Congress, and in culture.

For freedom,

David Bozell

President, ForAmerica

ForAmerica believes in guaranteed constitutional rights, including the right to life at every stage of life. We believe America should have unlimited education and economic opportunities. We believe America should be energy independent using American resources. We demand the freedom to speak and practice our faith. We will accept nothing less than fair and honest elections, and a government that is transparent, accountable, and stays off the backs of the American people as much as possible. The key objective of ForAmerica is to deliver wins on the cultural, electoral, and legislative fronts. When ForAmerica engages, America wins.

ForAmerica is a tax-exempt, not-for-profit corporation qualified under Section 501(c)(4) of the Internal Revenue Code (IRS). ForAmerica relies on the private financial support of the general public for its income, and accepts no government funds and performs no contract work. Donations are not tax-deductible consistent with IRS Section 170(c).

Comments